IFS Lease Accounting solution focusses on supporting companies to handle the accounting for lease/rental contracts in the view point of

Lessee in accordance with the applicable accounting standards. Through this solution, IFS Applications support accounting standards issued by the International Accounting Standards Board -IASB (International Financial Reporting Standards - IFRS (IFRS 16) and the Financial Accounting Standards Board - FASB (United States Generally Accepted Accounting Principles - US GAAP (ASC 842)). These accounting standards were jointly developed by the IASB and the U.S. FASB. But, there are differences between these two standards and one of the major difference is that, US GAAP requires to use two different accounting treatments depending on the type of the lease,

Operating or Finance (how to categorize lease contracts to these two types has been given in the US GAAP - ASC842). On the other hand, IFRS 16 requires only single model of accounting, called

Finance lease and which is similar to Finance lease under US GAAP -ASC 842. So, this solution focuses on supporting the two types of lease accounting,

Operating and Finance from the lessee's point of view.

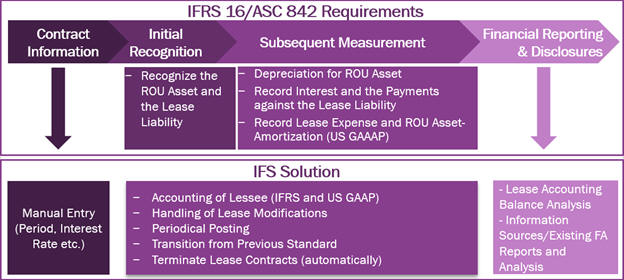

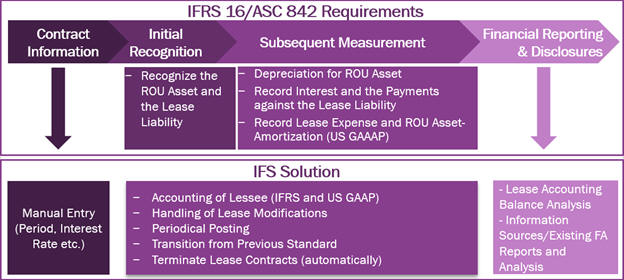

The requirements of these standards in a nutshell and the IFS Solution are depicted below.

ROU - Right-of-Use

IFRS - International Financial Reporting Standards

US GAAP - United States Generally Accepted Accounting Principles

The main areas that are covered by the Lease Accounting solution are explained below.

IFS Lease Accounting solution facilitates to enter the lease/rental contract related information based on which the lease accounting is performed such as lease payments related information, lease term, interest rates etc. This information should be entered manually in the header and the

General tab of the Lease Accounting

Contract window. Before entering information on

Lease Accounting Contract window, a fixed asset code part should be defined in the application. Refer the activities in

BDR (basic data requirements) For Fixed Assets Accounting to get more information on this. Also, it is required to complete the

BDR for Lease Accounting as appropriate where it is mandatory to define a

Contract Type to categorize the lease contracts entered in Lease Accounting window.

The

Accounting Information group box in the

General tab facilitates to define the applicable Accounting Standard and the

Leasing Type (Operating or Finance).

The information on how to enter data on the header and the

General tab of the Lease Accounting

Contract window is given in the

BDR for Lease Accounting.

After defining the lease contract related information as mentioned above, the present value of minimum lease payments and the amortization schedule for Lease Liability can be calculated as required by the standard using the right mouse button option

Create Amortization Schedule on the header and the

General tab of the Lease Accounting Contract window.

In the case of

Operating Lease, in addition to the amortization schedule of

Lease Liability, the amortization of Right-of Use Asset can also be seen in the

Amortization Schedule tab of the Lease Accounting

Contract window.

As per the above-mentioned standards, it is required to initially recognize a lease liability for the obligation to make lease payments and a right-of-use asset for the right to use the underlying asset which was taken on lease/rent for an agreed period. The lease liability is measured at the present value of the lease payments to be made over the lease period. The right-of-use asset is initially measured at the amount of the lease liability, adjusted for lease prepayments, in-cash or any kind of incentives connected to the lease contract (Example: Free rent period(s).) and costs of obtaining a lease that would not have been incurred if the lease had not been obtained (Example: Commissions paid to agents for establishing the lease.).

Before recognizing the lease liability and the right-of-use asset, the lease contract status should be set to

Active.

Also, it is required to define the Posting Types FAP 74, Lease Accounting, Recognition, Right-of-use Asset and

FAP75, Lease Accounting, Recognition, Lease Liability in

Posting Control window.

Further, a voucher type with

Function Group A - Fixed assets accounting transaction must have been defined in

Voucher Type window.

Also, it is required to connect a fixed asset object in the type

Right-of-use to the lease contract.

After defining the required basic data, by using the right mouse button option

Create Recognition Posting in the Amortization Schedule tab of the

Lease Accounting Contract window, the lease liability and the right-of-use asset postings can be created automatically. The posting of the right-of-use asset account is posted according to the posting type

FAP 74, Lease Accounting, Recognition, Right-of-use Asset. The posting of the lease liability account is posted according to the posting type

FAP75, Lease Accounting, Recognition, Lease Liability.

Note: The accounting treatment is the same irrespective of the

Leasing Type (Operating or Finance).

Also note that, it is also required to remeasure the lease liability and recognize an adjustment to the right-of-use asset in certain events (e.g., change in the lease term, change in variable leases/rents based on an index or rate). In order to handle these types of modifications the following options can be used.

The right mouse button option

Modify Amortization Schedule on the header and the

General tab of the Lease Accounting Contract window can be used to create the new amortization schedule after incorporating the lease terms related modifications.

Change in the variable leases/rents based on an index or rate can be handled using the right mouse button option

Change Base Index on a selected schedule line in the

Amortization Schedule tab of the Lease Accounting

Contract window.

The amounts to be recognized in Lease Liability and Right-of Use Asset due to such modifications can be seen in the

Difference in Liability field in the Amortization Schedule tab of the

Lease Accounting Contract window.

Those differences can be posted to the Lease Liability and Right-of Use Asset by using the right mouse button option

Create Recognition Posting explained above. Refer the

Modify Lease Contract activity diagram for more detail in this area.

Lease Contract Modification for multiple contracts can be performed from

Lease Accounting Contracts window and

Lease Contract Modification Details window.

According to the said standards, the subsequent measurement of Lease Liability and the Right-of-Use Asset differs based on the leasing type,

Operating or Finance.

In order to support subsequent measurement of Lease Liability, IFS Lease Accounting solution provides two types of proposals

Lease Accounting Periodical Proposal and Lease

Accounting Payable Proposal.

The

Depreciation Proposal can be used to depreciate the Right-of-Use Asset (under Finance Lease).

Note: The postings relating to the Lease

Accounting Periodical Proposal and

Lease Accounting Payable Proposal are handled through the

Function Group, LA - Lease Periodical Accounting (Store Original check box is mandatory for this

Function Group) and should defined in the Voucher Type window.

When the leasing type is

Finance, subsequent measurement of the Lease Liability should accrue

Interest Expense on the lease liability and reduce the liability to reflect the lease payments made. In this instance,

Lease Accounting Periodical Proposal can be used to create the interest related postings. It creates postings using the posting type

FAP 77 – Lease Accounting, Interest Expense (as a Debit entry) to the profit and loss account and the counter posting to the

FAP75, Lease Accounting, Recognition, Lease Liability (as a Credit entry) to the Lease Liability.

In order to reduce the Liability by the payments due, the

Lease Accounting Payable Proposal

can be used. It reduces the liability by using the FAP 75, Lease Accounting, Recognition, Lease Liability (as a Debit entry) and post it to a counter posting,

FAP 76, Lease Accounting, Counter Posting, Lease Payments Due (as a Credit entry). When the actual invoice or the payment is made, the account mapped for the posting type

FAP 76 should be used as the Debit posting in those processes, so that the invoices/payments can be reconciled against the value reduced from the lease liability.

Alternatively, you may opt not to use the

Lease Accounting Payable Proposal, instead, invoices/payments can be posted to the account mapped for the posting type

FAP 75 (Original Lease Liability).

Right-of-Use (ROU) Asset can be depreciated using the Depreciation Proposal in Fixed Assets. If it is subjected to any impairment, this can be handled as a Change Object Value adjustment to the fixed asset object.

When the leasing type is

Operating, subsequent measurement of the Lease Liability should accrue interest on the lease liability, but it should not be posted to the profit and loss account, instead, an equal amount of

Lease Expense should be charged to the profit and loss account (calculated by taking the total of lease payments, prepayments, direct costs and incentives dividing by the number of installments ).

The difference between the accrued

Interest and the Lease Expenses will be adjusted to the

Right-of-Use Asset (ROU) as an Amortization.

In this instance,

Lease Accounting Periodical Proposal can be used. It creates postings using the posting type

FAP 75 – Lease Accounting, Recognition, Lease Liability (as a Credit entry) to the amount of accrued

Interest Expense. And then, Lease Expense is posted to the posting type

FAP78, Lease Accounting, Lease Expense (as a Debit entry) to the profit and loss account.

The balancing amount is posted to the posting type

FAP 79, Lease Accounting, ROU Asset -Amortization. This should be a balance sheet account (as accumulated depreciation) and should be deducted from the

Right-of-Use Asset.

Under Operating Leasing, it is not required to depreciate the ROU Asset.

In order to reduce the Liability by the payments due, the

Lease Accounting Payable Proposal

can be used. It reduces the liability by using the FAP 75, Lease Accounting, Recognition, Lease Liability (as a Debit entry) and post it to a counter posting,

FAP 76, Lease Accounting, Counter Posting, Lease Payments Due (as a Credit entry). When the actual invoice or the payment is made, the account mapped for the posting type

FAP 76 should be used as the Debit posting in those processes, so that the invoices/payments can be reconciled against the value reduced from the lease liability.

Alternatively, you may opt not to use the

Lease Accounting Payable Proposal, instead, invoices/payments can be posted to the account mapped for the posting type

FAP 75(Original Lease Liability).

In order to support the financial reporting and disclosures two information sources have been introduced. Using the Business Analytics, the required information for financial reporting can be generated (E.g.: To get the values for disclosing the Short Term and Long-Term Lease Liabilities)

Further, a new Lease Accounting Balance Analysis window can be used to analyze the balances and transactions relating to lease accounting in transaction, accounting and parallel currency.

Also, the existing fixed asset analysis and reports can be used as appropriate for this purpose. Refer Follow-up, Fixed Assets activity diagram for details on existing fixed asset analysis and reports.

The existing contracts which have already been entered into and accounted differently to that is required in IFRS 16 and US GAAP- ASC 842, and now required to be accounted under these standards, can use the following steps to use Lease Accounting functionality for such contracts after the transition.

There are two possible ways that a lease contract can be terminated. One way

is, by ending the contract on or before the contract end date as agreed by the

parties involved, mainly lessor and lessee. The other way is, by purchasing the

underline lease asset on or before the contract end date by the lessee.

In

order to support these requirements, two right mouse button options are

available on the Lease Accounting Contract window, Terminate Lease Contract and

Acquire

Lease Asset. By using these two functions, automatic postings can be created as

required by the IFRS 16 and ASC 842 standards.

Refer the activity diagram

Terminate Lease Contract and the respective activity descriptions for detailed

descriptions of these two options including the new posting types introduced.

Termination of lease contracts can also be handled manually by using

Manual Vouchers. The balances to be cleared/transferred can be taken

from the Lease Accounting Balance Analysis window.

Contract status can be set to Closed by using the right mouse

button option Status on the Lease Accounting Contract window.

To aid this process, and other required changes (adjust rounding) on the

amortization schedule, the option of modifying the amortization schedule lines

is provided. In order to do that, the Modify check box should

be selected and a modify comment in the Modify Comment field

should be added for the schedule line that is required to be modified.

Further, the Scrapping functionality can be used to remove the values from the

existing fixed asset object (Right-of-use Asset), if the leasing type is

Finance Lease.